Accenture tipped as anchor at Barangaroo's International House

Global advisory firm Accenture has firmed as the anchor tenant for the Lendlease timber building known as International House being built at Sydney’s Barangaroo South.

It has a lease at GPT Group’s Workplace6 at Pyrmont until 2020.

Should Accenture move it is assumed the other tenant, Google, could take the space, which is about 7000 square metres. Google last year extended its lease at the Pyrmont site to 2021 as it awaits the redevelopment of the Bays Precinct at White Bay.

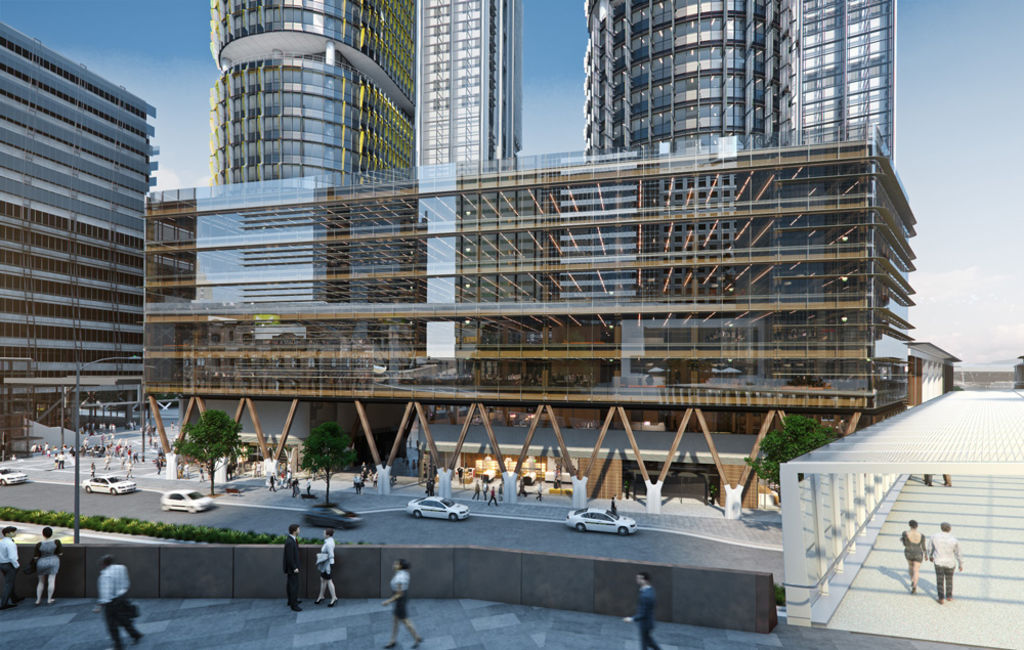

International House Sydney was acquired by Lend Lease International Towers Sydney Trust, the owner of Tower Two and Tower Three at Barangaroo and offers 6850 square metres of net lettable space across six storeys.

The managing director, Barangaroo South, Andrew Wilson, said International House Sydney fronted directly onto Exchange Square, an entry point into the precinct, and was designed by Jonathan Evans and Alec Tzannes, from architectural practice Tzannes.

International House Sydney is made from cross laminated timber (CLT) and glue laminated timber (Glulam) and due for completion this year.

The anticipated lease deal comes as Sydney landlords are in the box seat with low vacancy at about 6 per cent, falling incentives and strong demand from growth in white-collar jobs.

With the market in Sydney and Melbourne now strengthening and turning in the landlord’s favour, the question is whether all of this talk of customer centricity will be displayed by the landlords.

The managing director, office and industrial, at AMP Capital, Luke Briscoe, said customer centricity was not a fad, but the approach did need to be genuine.

“The most sustainable and successful companies around the world have a clear mandate on their customer approach, irrespective of market conditions. Performance is directly related to their proactive response to understanding customer needs,” Mr Briscoe said.

“AMP Capital’s vision is to be the ‘preferred partner in real estate’. As we are providing a platform for our customer’s success, a one-size-fits-all approach does not work, rather we need to deliver bespoke solutions, whether the market is strong or not. We do recognise though when it comes to our service offer we have the opportunity to be more consistent, reliable and inclusive.”

Mr Briscoe said the real estate sector in Australia was one where the benefits of this consistent approach could be quantified.

“Sydney and Melbourne are currently quite strong, while Perth has some clear challenges. Many of our customers and their advisors are national firms and it would be far from ‘customer centric’ to offer innovative customer solutions in one market, but then not in another. Our customers would see straight through this,” he said.

“To demonstrate the point, we are pleased to see the benefits of our consistent approach at our assets in Perth. Across our managed assets in Perth we have leased over 25,000 square metres in the last 12 months, with many being national businesses. Of the 15 transactions, 10 of them were renewals, which is a strong indicator that we are delivering on the customer promise nationally,” Mr Briscoe said.

“While the outcome is to drive strong returns for our investors, we remain mindful that our returns are delivered through full buildings and happy customers – being too opportunistic in the short term will not deliver long-term sustainable outperformance for our investors.”