Building boom fills Walker's coffers as Rich Lister gets set to jet

Billionaire developer Lang Walker collected more office rents and made better sales from his housing projects over the course of the 2020 financial year, with his vast property empire proving remarkably resilient during the worst of the pandemic disruption.

While the high-flying AFR Rich Lister’s wings were clipped for much of the period by COVID-19 travel restrictions, Walker Group’s key revenue streams prospered, benefiting from both the housing boom and increased income as office developments in Sydney and Melbourne were completed and leased up.

Mr Walker’s interests stretch from office towers in Sydney and Melbourne, to a 30,000-lot land bank of greenfield housing across Australia, three extensive housing estates under development in Malaysia, and the high-profile private island resort in Fiji, Kokomo.

Office rental income – including from multi-tower projects at Parramatta in Sydney and in Melbourne’s Docklands – rose almost 30 per cent to $203.6 million.

Development sales from housing estates in Australia and Malaysia lifted almost 10 per cent to $93.6 million. Walker Group’s residential pipeline includes 20,000 apartments in Australia and 45,000 dwellings and a golf course in the southern Johor Bahru region, opposite Singapore. In all, Walker Group’s development pipeline amounts to around $30 billion.

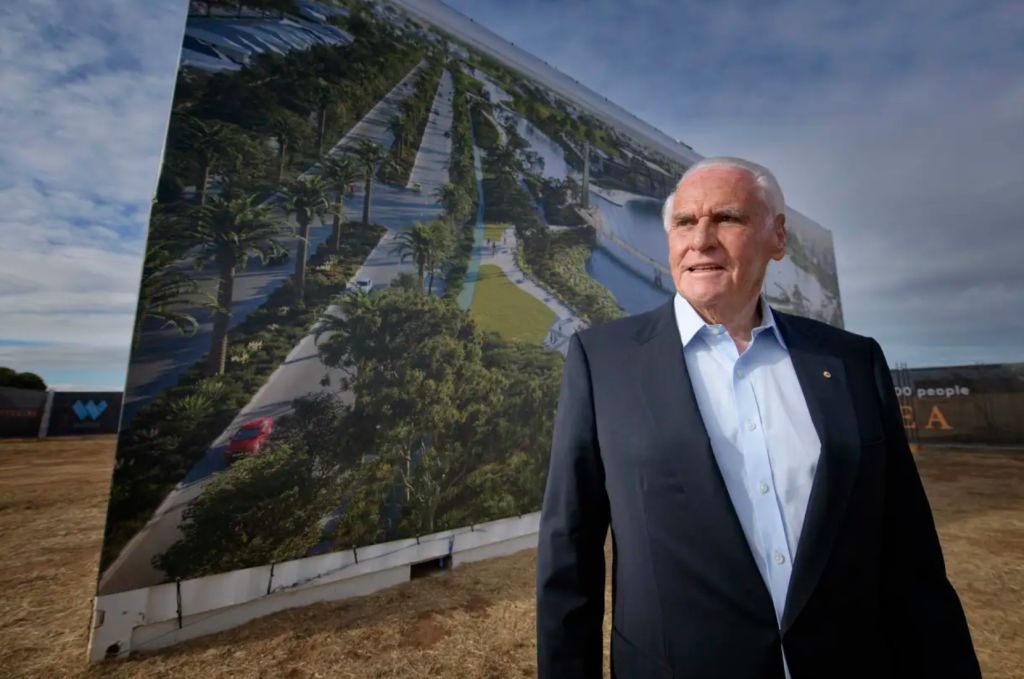

Earlier this year, Mr Walker launched the $3 billion Riverlea housing development in northwest Adelaide, which is shaping up to be the state’s largest master-planned community yet.

Financial results lodged this week with the corporate regulator show Walker Group’s statutory profit fell to $174.1 million from $251.2 million, after booking in a lower valuation gain on investment properties than the previous year.

That inclusion, an accounting requirement, reflects a cautious approach on the valuation of investment property due to COVID-19.

But the billionaire, the sole shareholder of Walker Group, remains confident enough in the resilience of the underlying earnings, collecting a $2 million dividend, just a touch less than last year’s take-home of $2.1 million and double the pay-out of two years previous.

The luxury Fijian resort of Kokomo was closed through much of the pandemic, and hospitality revenue from across the group fell to $2.1 million from $25.4 million a year earlier.

As Mr Walker presses ahead with his latest commercial projects, including the four-tower Parramatta Square development, the value of the company’s investment property holdings, both completed and under construction, has risen to $5.6 billion, up from $4.9 billion a year earlier.

The lockdowns generated one saving though, with the globe-trotting property magnate charged just $281,000 for the use of a private jet over the 2021 financial year, compared to $760,000 a year earlier.

All of that is about to change though, with Mr Walker quick to embrace the lifting of the international travel ban with an itinerary that includes a trip to the Malaysian projects within weeks, a jaunt over to Kokomo in Fiji after Christmas, followed by a longer sojourn in Europe in May next year. The family’s 58.5-metre sloop is anchored in Mallorca.

“It’s an unbelievable feeling to see things moving again,” Mr Walker told The Australian Financial Review earlier this week. “It’s hard to express what a relief it is that we can travel again.”