Charter Hall boosts its "Paris end" portfolio

Diversified fund manager Charter Hall has extended its presence in Melbourne’s “Paris end”, buying the freehold of the Collins Place precinct for an estimated $60 million.

Under the deal, the group’s wholesale Charter Hall Prime Office Fund, will buy the freehold from an unnamed vendor and will hold it for 107 years. The AMP Wholesale Office Fund will retain the leasehold for the 13,350 square metre site which is home to the twin towers of the ANZ Bank and the Sofitel Hotel.

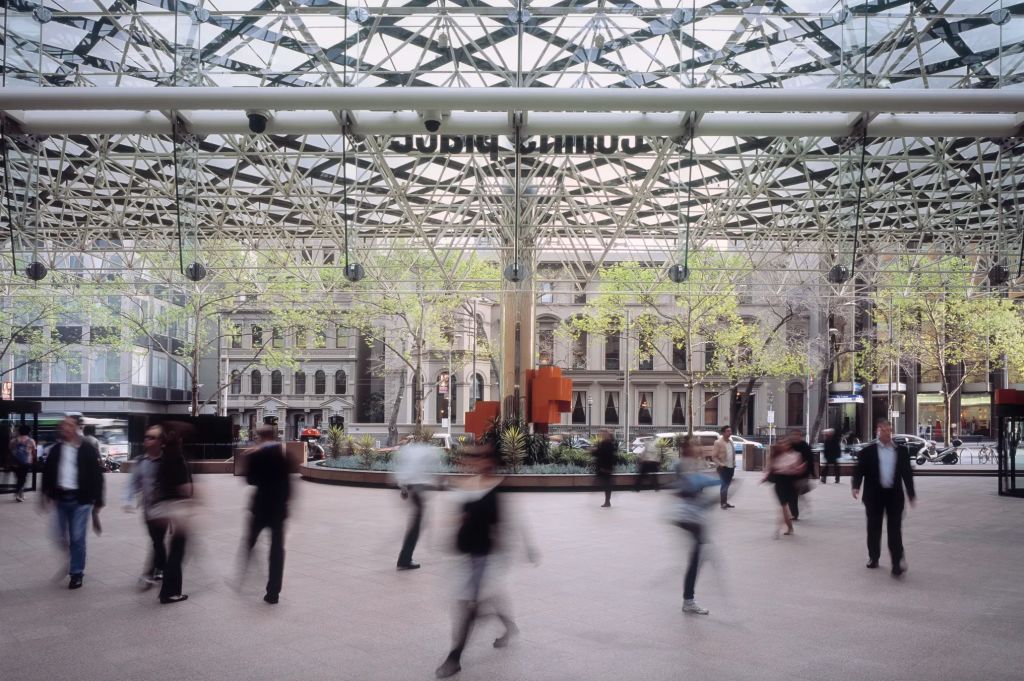

Sitting at 35 and 55 Collins Street, it is in the prime of what is known as the Paris end of the city. It will add to Charter Hall’s other assets in the area of the recently purchased Southern Cross towers — the Wesley precinct, the Telstra HQ at 242 Exhibition Street and 11 and 288 Exhibition Street.

“We are pleased to have added to our Paris end footprint, with the largest CBD land holding in the Paris end totalling 40,000 square metres of CBD land,” Charter Hall’s chief executive David Harrison said.

“Collins Place presents a unique opportunity for the office fund’s investors to secure one of the largest, freehold title, prime CBD sites nationally.”

The deal will boost the ASX-listed Charter Hall’s suite of assets under its large-scale $80 billion funds under management. The group has a market value of $6.1 billion and owns, manages and co-invests in malls, office towers, petrol stations, pubs and large format retailers.

The purchase comes as the office market undergoes its structural change to hybrid and flexible work practices driven by the global pandemic. Colliers, national director, Melbourne CBD office leasing Andrew Beasley said in recent office commentary that there had been a flight to quality by tenants.

“Tenants of all sizes are electing to upgrade their accommodation, not only to encourage their staff to return to the office, but as a retention and attraction strategy in a tight labour market,” Beasley said.

“Landlords that are choosing not to upgrade their buildings to meet the demand for quality and higher environmental ratings are likely to be left behind.”

Colliers’ Adam Woodward acted for the vendor.

Collins Place was built by AMP and opened in 1981 with the bank as the anchor and the former Regent Hotel. It has 140,000 square metres of office space across two towers, together with the now Sofitel-managed hotel and street frontages to Collins and Exhibition Streets and Flinders Lane.

Harrison said there were longer-term plans to upgrade the area as part of the Charter Hall development strategy that it is also undertaking in Sydney with its Chifley Tower complex.

“We have long recognised the value of freehold land and precincts, demonstrated by the 2019 purchase of Sydney’s premium office precinct, Chifley Tower and the subsequent planning process to develop a complimentary South Tower to the existing North Tower,” Harrison said.

“Charter Hall’s strategy, to unlock under-utilised floor space in prime locations that have the potential to add value to the freehold asset over time, ultimately delivers long-term value.”