East Melbourne office tests investors as rates rise

A five-level commercial office offered for sale by Adelaide-based fund manager Harmony Property Investments will be an early test of investor appetite in a rising interest rate environment.

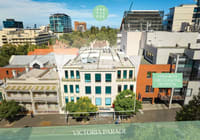

The East Melbourne building, developed by the failed Becton Property Group and purchased by Harmony in 2009, is expected to fetch more than $60 million. It backs on to a gleaming residential tower that was part of the original complex.

The property is being pitched to investors just as the Reserve Bank lifted the official cash rate from 0.1 per cent to 0.35 per cent, the first increase since November 2010 and the first rise in the midst of an election campaign since 2007.

Analysts expect the higher cost of debt to have an impact across the property sector, not just on residential buyers.

“We estimate up to a 20 per cent earnings headwind from a higher cost of debt,” Macquarie’s analyst said about the impact of rising rates on Australia’s real estate trusts.

The building at 289 Wellington Parade South, occupied primarily by Arthur J. Gallagher & Co, is one of the few large offices located on the eastern fringe of the city’s CBD.

Selling agent Colliers International’s Daniel Wolman said despite Tuesday’s rate increase, the cost of debt was still at historic lows.

“Even with a slight increase, they’re still low and the cost of debt is affordable. Investors that we are speaking to are not scared by it, and they can still see value in real estate,” he said.

East Melbourne is one of the city’s most tightly held office markets, and has little turnover of assets.

“Based on that, we expect high demand from investors both locally and offshore,” Wolman said. “It’s as prime as it gets for the fringe of the city. It’s close to the east end, the most prestigious pocket.”

The building, one of a dwindling supply of offices in the suburb, has 5500 square metres of lettable area and is on the south side of the Fitzroy Gardens, next to the Jolimont rail yards.

On the other side of the gardens, property veteran Brendan Sullivan is taking advantage of the suburb’s premium status among high-end apartment buyers to turn an eight-level building he owns at 122-130 Wellington Parade into whole-floor apartments and add a three-level carpark at the rear.

Macquarie’s analysts said some retail and office landlords are likely to be protected by leases that have inbuilt increases linked to the Consumer Price Index, but market dynamics were likely to determine the ability of tenants to withstand higher rents.

“The higher cost of debt is also likely to have additional impacts to the REITs, including more limited accretion from acquisitions and developments as well as a headwind to equity flows and asset values for certain sub-sectors,” they said.

“We therefore view rental growth offsets to be more limited in retail and office, with industrial fundamentals providing a greater offset.”