JLL revenue growth on hot property leasing market

The Australian operation of global real estate group JLL has reported record growth in its business for the seventh year running with the areas of leasing and investment sales showing some of the strongest results.

JLL Australia chief executive Stephen Conry said organic growth and increased market share as well as a number of acquisitions delivered the result.

“The 28 per cent lift in JLL’s office leasing revenues for 2016 was a record year for our national team and reflects active markets, in particular Sydney and Melbourne, and our growing market share across the country,” he said.

“JLL investment sales continues to have strong market share, which contributed to the 25 per cent lift in revenues in 2016.”

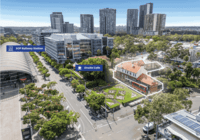

JLL transacted two of the five biggest agency-negotiated office deals in 2016 – the 75 per cent stake in Sydney commercial office asset 420 George Street for $442.5 million and Woolworth’s headquarters in Sydney’s Bella Vista for $336 million.

“Of all direct retail investment deals in the 2016 market JLL was again the leading retail broker, transacting a total of $2.7 billion and 70 per cent by volume of the agency negotiated deals over $150 million.”

The company’s property and asset management division also showed good growth up 11 per cent.

Globally JLL saw fourth-quarter revenue up 14 per cent to $US2.2 billion ($2.86 billion) while fee revenue of $US1.8 billion was up 11 per cent.

“We recorded double-digit revenue growth for both the fourth quarter and full year of 2016, driven by recent acquisitions and organic growth,” JLL chief executive Christian Ulbrich said.

“Going forward, we are focused on translating our increases in revenue and strategic investments into accelerated profit growth.”

Globally JLL’s transactional businesses grew despite a worldwide decline in market volumes, notably in the UK.