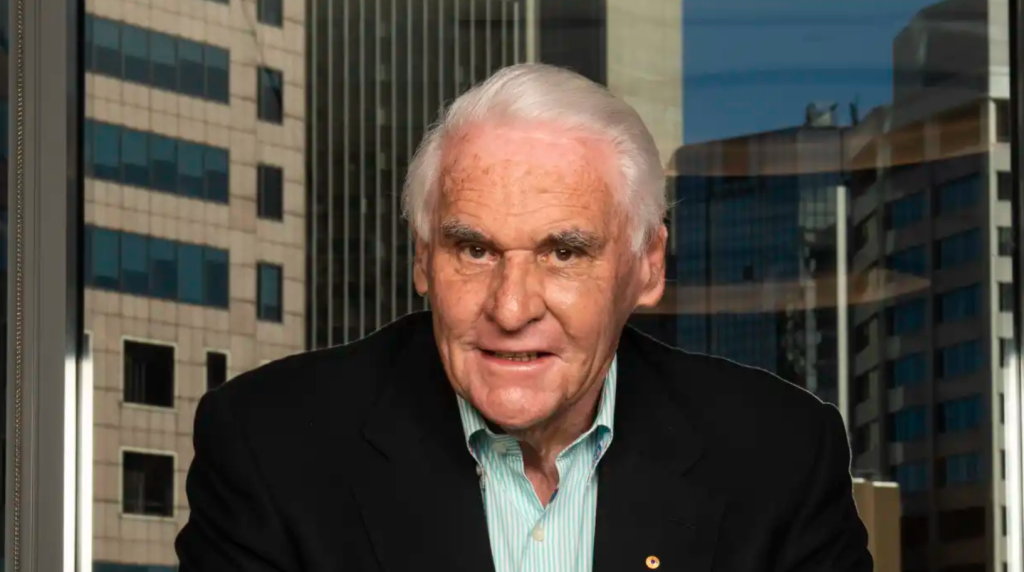

Lang Walker doubles his dime as property empire weathers pandemic

Billionaire developer Lang Walker doubled his take-home dividend to $2.1 million in fiscal 2020 with revenue from office rents and housing sales rising, as he steered his expanding property empire through the early stages of the pandemic.

Mr Walker is the sole shareholder of Walker Group Holdings, with a property portfolio stretching from office towers in Sydney and Melbourne, to a 30,000-lot land bank of greenfield housing across the country, a vast housing estate under development in Malaysia and a high-profile private island resort in Fiji.

Financial results signed off at the end of October for the year to June 30 show the property portfolio traded through the coronavirus disruption relatively unscathed. Valuations brought to book from Mr Walker’s investment in listed bio-techs took some of the shine off the bottom-line, however.

Rental income from investment properties, chiefly landmark towers in Sydney and Melbourne, rose to $157.7 million from $119.6 million in the previous year. Property development sales stepped up from $76.4 million to $85.4 million.

“To date the group has not experienced a material reduction in rental revenue nor a material change in demand for office space,” the 2020 financial filing stated.

Walker Group’s results can swing from year to year as it moves through different stages of the development cycle. As a private developer, Mr Walker can absorb that volatility without the obligations of more regular returns to public market investors.

This year was no different, as the bottom line profit fell back to $251.2 million from $363.5 million. One wild card driving the dip this year was the $68.8 million net loss Mr Walker booked on his equities exposure after recording a $101.5 million gain the previous year. He declined to comment on his 2020 result.

Mr Walker has significant stakes in two listed bio-tech players – Next Science, which listed last year, and Atomo Diagnostics, which floated this year.

Ranked 19th on this year’s Financial Review Rich List, Mr Walker has a well-earned reputation for making astute calls on the property market, including his strategic shift a few years ago to quit medium-density residential apartments and focus on the commercial market. More recently he pulled back from a move to divest his Collins Square project four years ago, only to see its value rise subsequently.

As Mr Walker presses ahead with his latest commercial projects, including the four-tower Parramatta Square development, the value of the company’s investment property holdings has risen to $4.9 billion, boosted in part by a $362 million revaluation upwards on the office towers. That gain was justified, the report said, because there was little market evidence so far that values in sector had been hit.

However the pandemic-induced border closures were felt elsewhere by Walker Group, which reported it had “no option” but to close a resort, understood to be the luxurious Kokomo private island resort in Fiji. Overall hospitality revenue fell to $25.4 million from $29.7 million.