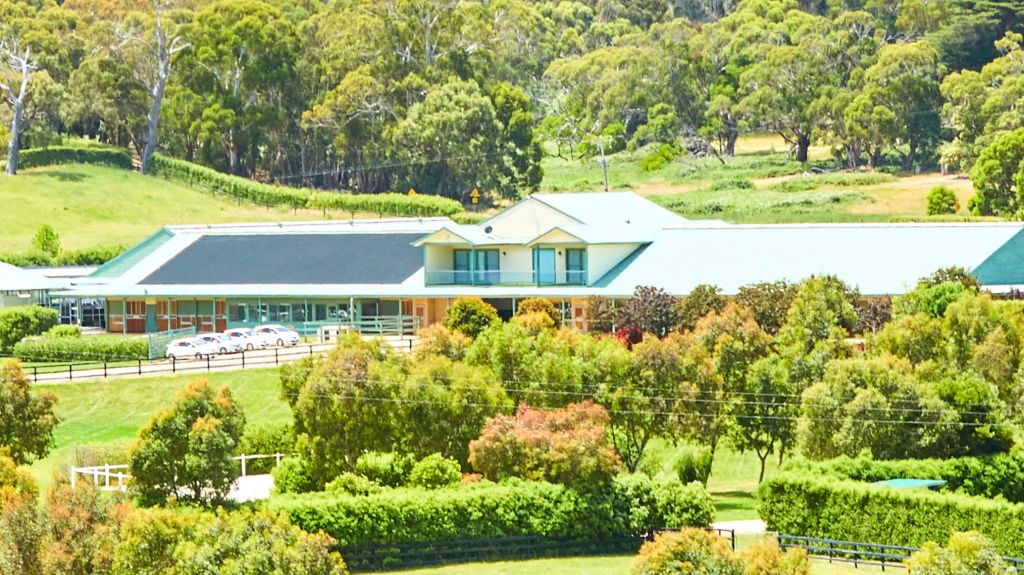

Macedon Lodge trots back to the sales yard

The horse-whispering Williams family have put Macedon Lodge back on the market two years after the pandemic stalled an earlier campaign.

Lloyd Williams, long-time racing luminary and former developer of Crown’s massive riverside casino, has stated he is committed to an immediate sale.

It is believed the price tag on the 120-hectare property is around $10 million, half the $20 million minimum touted in late 2019.

The estate reportedly attracted six potential buyers but a deal fell through as the pandemic hit. Several Melbourne Cup winners have been trained at Macedon Lodge.

Situated on the southern slopes of Mt Macedon, the estate comes with a full suite of equine-focused training and health facilities, including stabling for 150 horses, training for a further 80 and a 75-metre saltwater swimming pool.

For the humans, there are five apartments, two houses, a caretaker’s flat and the owner’s apartment above the main stables – for when you need to be close to your horses.

Inglis Rural Property and LAWD have been appointed by Mark Wizel of Advise Transact to manage the sale on behalf of the Williams family.

“This is a once-in-a-lifetime opportunity for a buyer to access one of the most prestigious and workable properties ever to come on to the market in Australia,” Jamie Inglis said.

“Every element of Macedon Lodge has been purpose built to enhance the wellbeing and preparation of the thoroughbreds trained there,” Mr Inglis said.

Luxury yard

Toorak’s Mercedes-Benz car yard, situated in the heart of the Toorak Village shopping strip just off Toorak Road, is likely to be one of the more valuable development sites to hit the market this year.

The 3532 square metre site at 17-19 Carters Avenue is expected to fetch more than $70 million.

The property, which has two street frontages, is selling nearly two years after the death of luxury car dealer John Worrell, whose family established the dealership in 1921.

Worrells Motors, founded by Mr Worrell’s father Ted, was originally next door to the Toorak Hotel – the Tok H – before moving to horse stables on Carters Avenue in 1931.

There are two years remaining on the lease to Nick Politis’ Eager Automotive.

Expressions of interest in the landmark property are being handled by Allard Shelton’s Joseph Walton, Christian Hatzis, Michael Ryan and Patrick Barnes and CBRE’s Nathan Mufale, David Minty, Scott Hawthorne and JJ Heng.

Other recent landmark deals in the Village were done at $20,000-25,000 a square metre, including Bill McNee’s acquisition of the Village Way Arcade for $58 million and Orchard Piper’s $20 million purchase of the chemist shop at 109 Mathoura Road.

Blue-chip retail

The year has really kicked off when the blue-chip retail asset hits the market. Fresh for delivery is the former Brighton post office in the heart of the seaside village’s shopping strip.

The retail complex is expected to sell for more than $15 million.

The 990 sq m building is leased to runners giant Nike, local comfort shoes retailer Ecco as well as French boulangerie Laurent and two office tenants. It returns $705,886 a year.

Fitzroys’ Chris Kombi and Mark Talbot and Aston Commercial’s Jeremy Gruzewski and Liam Rafferty of Aston Commercial are selling 71-73 Church Street via expressions of interest.

Records show it is being offloaded by the descendants of ragtraders Alex and Judy Resofsky.

“This is undoubtedly one of the best strip retail investment opportunities in Australia,” Mr Kombi said.

Just two properties have sold on the strip since September 2019 – the NAB branch at No.35 for $6.1 million on a 3.5 per cent yield and the Oroton shop which fetched $6.07 million on a 2.5 per cent yield.

Fitzroys also have a shop to sell on another of the city’s blue-chip strips at 566 Burke Road, Camberwell which presents the first big auction for the year.

Fitzroy’s Chris James and David Bourke are auctioning the property on March 17. It’s expected to sell for more than $7 million. NAB’s lease on the 646 sq m two-storey branch runs out in June.

On a hill

The Church of England is selling a church in what is possibly one of the city’s coolest shopping villages.

The church, and its vicarage at 223a Tyler Street, is on a 2622 sq m site on the corner of Plenty Road. High on the hill with views to the city, it’s at the gateway to a strip dominated by mid-century modern architecture.

It’s half-way between the Summerhill shopping centre and the junction where High Street splits into Plenty Road. Darebin planning has it earmarked for a six-storey project.

The northern suburb is undergoing rapid change with many of its large industrial and retail properties selling to developers. The junction is already home to skyscraper apartments.

Last week, the Preston Toyota, which is on a 1.6 hectare site at 687 High Street, sold for $40 million to build-to-rent group Make Ventures.

And closer to the junction, Altis Property Partners and Aware Super paid $14 million for a 3029 sq m site at 6-34 High Street which has plans for a mixed-use 18-level apartment tower.

Dawkins Occhiuto agent Walter Occhiuto and Tim Grant are handling expressions of interest which close on March 3. Maple Property Partners’ Todd Solomon is acting for the vendor. It’s expected to sell in the high $5 million range.

Down the road, another site from failed developer Steve Paglia is for sale. The 974 sq m property at 73-77 Plenty Road, on the corner of Raglan Street, is expected to sell for more than $3.7 million – just a bit more than it fetched five years ago.

Gross Waddell ICR’s Andrew Greenway and Danny Clark have been appointed by receiver BDO to sell the property by auction on March 24.

Methven Park

Colin De Lutis is selling the remainder of his East Brunswick site at 20 Leinster Grove, overlooking Methven Park.

The 4352 sq m site is the balance of the Lygon Place development built by the DeGroup on the former factory sites where the De Lutis family once manufactured the very fashionable Westco jeans.

Colliers agents Jozef Dickinson, Trent Hobart and Yvonne Zhou and JLL’s Nick Peden, Jesse Radisich and Josh Rutman are handling expressions of interest, closing on March 23. It’s expected to fetch more than $17 million.

Meanwhile, south of the city, developer Peter Gibson is selling 600-604 North Road, Ormond, a two-storey office building on a 1412 sq m site with permits for a six-level project.

Gorman Commercial agents Jonathon McCormack and Stephen Gorman and JLL’s Mr Peden, Mr Radisich and MingXuan Li are selling the property and expecting more than $5 million.