Office landlords in suburban Melbourne adapt to the realities of a changing market

COVID-19 lease clauses allowing for delays in the take-up of new space have become prevalent in Melbourne’s fringe and suburban office markets.

Larger tenants with leases commencing in 2021 and beyond remained active in the market and, while some included such COVID-19 clauses to postpone occupancy if it was not currently feasible, a growing number of tenants were delaying deals as they waited to see how the situation evolved over the coming months, said CBRE head of office leasing Ashley Buller.

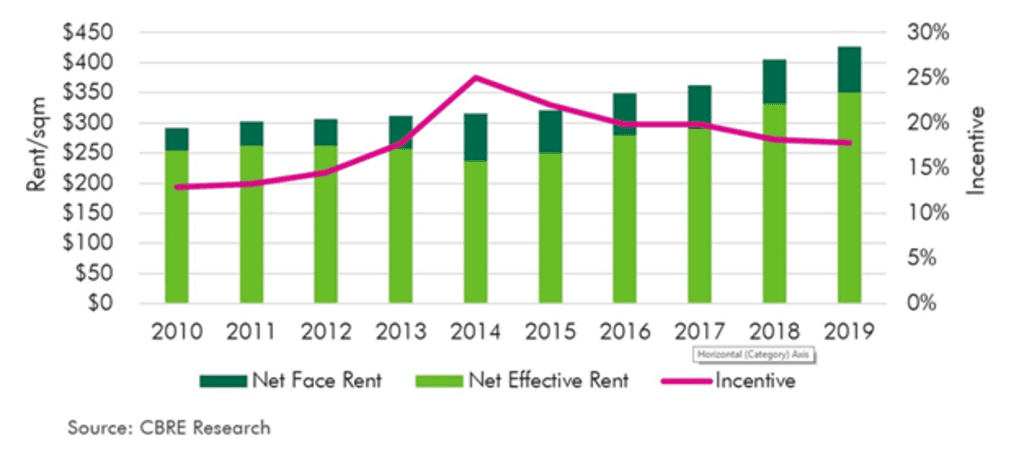

“Due to the heightened potential for vacancy risk, some landlords are acting decisively and offering competitive terms upfront to close transactions,” he said.

“At this stage, we don’t see face rents being affected, however, we anticipate incentives to rise.”

Melbourne’s fringe and suburban office markets delivered 43,145 square metres of future office accommodation options in Q1 2020, with a further 180,740 square metres due throughout the year, JLL’s Victorian office leasing senior director Josh Tebb said.

“We predict rents to increase further when new developments complete in 2020 and foresee a change in stock composition,” he said.

“Pre-lease rents have already established a new benchmark in the region of $550 to $600 for quality A-grade stock. That said, in the early stages of the second quarter we are only just starting to see the impact of COVID-19 and the resulting pressure that this will put on vacancy and rents in the medium term.”

Meanwhile, office rents in the small inner suburb of Cremorne and Richmond have almost doubled in the past four years, as demand from younger workers changed the face of the workforce, according to research from Knight Frank.

Rents in the creative hub of Cremorne soared by 80 per cent during the past four years, from $300-$320 to $550-$600 a week, said James Treloar, Knight Frank’s head of metropolitan leasing.

He said the spectacular rise in rents could partly be explained by the fact much of the demand stemmed from Millennial and Gen-Z workforce tenants who continually sought to attract and retain talent.

“These groups typically aren’t concerned about congested streets and lack of parking, however, are attracted to the high level of quality of amenity,” he said.

Jason Stevens, Herron Todd White office director, said Cremorne was gaining a reputation as Australia’s unofficial version of Silicon Valley as it was attracting major technology companies, new start-ups and other creative businesses.

Middle-ring south-eastern metropolitan suburbs such as Mount Waverley and Glen Waverley were considered good value because they offered good quality office stock in business park environments serviced by retail amenity and transport linkages, Mr Stevens said.

“Rents for good-quality office premises are also relatively affordable at $300 to $350 per square metre compared to say Richmond and Cremorne at approximately $450 to $500 per square metre for similar quality stock,” he said.

“Collingwood is also becoming popular as a more affordable fringe CBD alternative.”

Lemon Baxter commercial-industrial sales and leasing director Ben Hackworthy said many fringe and suburban tenants were reviewing their rents, with A-grade tenants moving to B-grade to save costs.

“A lot of other companies will realise the need for downsizing and reducing quality to reduce overheads,” he said.

M3 property associate director Niall Ashleigh said East and North Melbourne, and Collingwood presented good value as they were near city markets with great amenity and strong public transport linkages.

“We see a theme of tenants wanting to be in areas with strong retail [food and beverage in particular] amenity, as well as availability of public transport, and see these areas as providing this to potential tenants and close to the CBD,” he said.

St Kilda Road prime-grade rents offered the best value in the fringe market, largely due to the older age of stock, Mr Tebb said.

“St Kilda Road still provides occupiers with close connectivity to the CBD and the future benefit of major infrastructure due to be delivered in 2024 in the form of Anzac Station.

“This will be an absolute game-changer for this market.”

In the suburban market, areas such as Mount Waverley, Mulgrave, Caribbean Park and Essendon Fields offered the best value, and in addition to affordable pricing they presented new high-quality projects and private and institutional grade owners, CBRE advisory and transaction director Anthony Park said.

“Rents in the suburban areas highlighted are circa early to mid-$300s per square metre for a new A-grade space. For an A-grade space on St Kilda Road you are looking at mid-to-high $400s per square metre,” he said.

“Suburban areas are typically targeted by companies that have links to the industrial sector or have a workforce that predominantly live locally. These companies usually have a large proportion of staff that require a car for work or transport. Parking in these areas is affordable.”