Redcape sells trio of pubs for $136m to meet priority redemptions

Pub owner and operator Redcape Hotel Group has quietly sold three gaming pubs across Sydney for a combined $136 million to meet priority redemptions, following a nine-month pause to withdrawals.

One of the big unlisted real estate funds in ASX-listed MA Financial’s stable of alternative asset investments, Redcape has been selling pubs to fund payouts and strengthen its under-pressure balance sheet.

The hotel fund, which was previously listed on the ASX before exiting in November 2021 after just three years, had frozen its redemptions as it worked to gain more liquidity through asset sales. In April, the fund said it would unfreeze its redemptions.

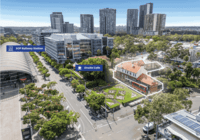

On Monday, Redcape said it has sold the Kings Head Tavern in Sydney’s south to Melbourne-based Francis Venues, and divested the Eastwood Hotel and the Australian Hotel & Brewery in Sydney’s northwest to hospitality upstart Sonnel Hospitality.

The total value of those three deals was $136 million, meaning Redcape has divested more than $300 million of assets in less than a year. The assets were sold on a blended yield in the range of 7 per cent to 7.5 per cent.

“This strategic move is part of Redcape’s active portfolio management strategy aimed at enhancing fund earnings and returns for investors,” Redcape managing director Chris Unger said.

“The fund continues to see pleasing operating performance across the portfolio, with sustained customer visitation and well-managed costs. The fund has delivered growing distributions across the year and these divestments put us in a strong position to selectively acquire venues that will complement that strategy.”

Mr Unger said the fund has commenced addressing priority redemptions as a result and would provide $40 million of liquidity over the next year.

Previous divestments driven to increase liquidity include the Fairfield-based Crescent Hotel and Mount Annan Hotel near Campbelltown, both located in Sydney’s southwest, for almost $100 million.

Last year, Redcape sold the Unanderra Hotel in Wollongong to Bill and Mario Gravanis’ Oscar Hotels for $14.5 million. Other divestments include the Aspley Hotel in Brisbane, the Grove Hotel in Mackay, the Shafston Hotel in East Brisbane and the Central Hotel in Shellharbour.

The slew of deals has bolstered Redcape’s balance sheet, in turn allowing the fund manager to meet priority redemptions and deliver a distribution of 2.30¢ per unit for the June-2024 quarter, which is a 15 per cent increase from the previous quarter.

Mr Unger said Redcape remained on track to reach its target distribution of 2.30¢ per unit for the September quarter, and would focus on increasing returns back to 10¢ per unit a year and beyond “in the near term”.

The latest trio of pub deals was managed by HTL Property’s Andrew Jolliffe and Dan Dragicevich, who described the divestments as the largest transactions of the year across the national hotel landscape.