‘Unloved, under-rented industrial’ a sweet spot for new fund

Irongate has joined the wave of fund managers funnelling capital into the booming industrial property sector, but with a twist: it will focus on buying properties that none of its bigger competitors seem to want.

The former ASX-listed group, which relaunched in April following a management buyout of its platform from Charter Hall, has secured seed funding from its Johannesburg-listed backer Burstone Group (formerly the Investec Property Fund) for its new industrial property fund.

In addition, Hong Kong-based private equity firm Phoenix Property Investors has co-invested in the unlisted fund’s first asset, an under-rented, partially vacant industrial complex in Smithfield in Sydney’s western suburbs.

The complex was acquired for $57.25 million from the Katz family’s EK Nominees, owner of the St Ives Shopping Village on Sydney’s north shore. Colliers agents Trent Gallagher, Gavin Bishop, Sean Thomson, and Peter Dale brokered the sale.

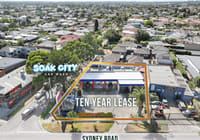

The Irongate fund’s seed asset comprises the adjoining properties of 338-350 Woodpark Road and 1 Dupas Street, which offer a combined land area of 3.4 hectares and a total net lettable area of 17,546 square metres across eight buildings.

The fund manager acquired the properties on an initial yield of 3.7 per cent, but expects to be able to lift income returns to over 6 per cent over the short term by leasing vacant space and resetting rents on existing tenancies to current market rates when they expire. The estate was acquired with a weighted average lease expiry of just 1.7 years.

Irongate CEO Graeme Katz (not related to the Smithfield vendors) said the fund’s focus was on acquiring “under-rented and unloved assets on good landholdings”, a niche the bigger end of town largely ignored.

“The real estate investment trusts are focused on new shiny things. We believe there are a number of opportunities, where, with hard work, we can unlock value in these infill sites,” he told The Australian Financial Review.

Irongate was also comfortable having small manufacturing companies as tenants, a category the “bigger guys don’t like”, Mr Katz said.

“We don’t mind these sorts of tenants, which tend to be stickier than others. We’re happy to take on things that aren’t fashionable for the REITs.”

Irongate’s launch of its unlisted fund comes as peak construction body ACIF forecast $10 billion-plus in new industrial property investment this financial year, and similar amounts over the next two financial years.

Highlighting how strong demand is for industrial assets, ACIF’s latest estimates added a cumulative $4.4 billion over the combined three years to forecasts made just six months earlier.

While much of this investment is in new facilities, Mr Katz all but ruled out pursuing brownfield or greenfield developments, saying he found it hard to understand how such projects stacked up, given high land and construction costs, plus all the other costs associated with development.

“It’s fascinating to see the REITs selling income-producing commercial assets to fund their industrial development pipeline, how do they make money? Why sell an income-yielding asset bought on decent money and then convert that to development risk?” he said.

Mr Katz said Irongate had bought the Smithfield estate at below land and replacement cost and without having to take on any development risk.

In addition, with a short WALE and two vacancies the estate offered the opportunity for Irongate to generate higher income returns through positive rental reversions.

With industrial vacancy rates at 0.2 per cent in western Sydney, Irongate has already secured tenants for two empty sheds: a logistics firm and a light industrial manufacturer.

Mr Katz said the investment was not just about generating significant rental increases.

“We’re giving love to an unloved site through roofing, painting and improving fire and safety,” he said. “We’re spending capital to improve the amenity.”

With higher rental income and building refurbishments expected to also generate capital growth, Irongate expects to deliver total annual returns in the mid-teens.

Mr Katz declined to reveal growth targets for its new fund, but said the Smithfield acquisition was the first of many Irongate intended to make in the short term.

“We have our sights set on a number of under-rented assets in key logistics hubs across the country,” he said.