There is tremendous upside to this purchase and with a few updates here and there, the potential to increase the rents on this fully tenanted investment, make this a property the astute buyer must consider.

Currently returning a gross annual income of $176,320 + GST, with a total net lettable area of 1,698m2, a quick overview of each property has been provided below:

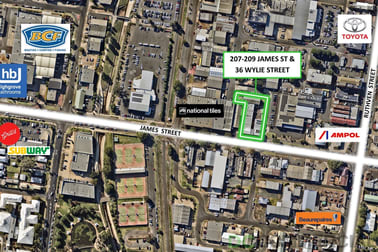

At an existing 6.45% net yield with upside, 207-209 James Street and 36 Wylie Street incorporates 3 lots and features:

3 Retail Shop Fronts (approx. 46m2 each)

5 x Industrial / warehouse units (approx. 112m2 each)

1 x Large Warehouse (approx. 400m2)

2 x Upstairs tenancies currently leased as residential (approx. 140m2 each)

Onsite amenities

Onsite parking at the rear

36 Wylie Street, situated at the rear of 207-209 James Street and on a separate lot, with its own entrance off Wylie Street features:

320m2 tilt panel / metal clad shed with an internal air-conditioned reception / office space.

Internal amenities include male and female toiles and a shower

2 x High bay roller doors providing access with parking at the front.

Zoned Mixed Use, this code allows for a large variety of business uses including gyms, bulky goods retailers and offices, and with limited spaces zoned within this category, adds a huge advantage to this already incredible investment.

207 209 James Street & 36 Wylie Street present an incredible opportunity for an investor / developer to take advantage of highly exposed location and the current returning income.

UPSIDES upgrade the site and increase the rental return, with the potentially to sell the lots individually in the future!

For more information on this savvy investment opportunity contact Drew Camm DC Commercial on 0432 055 250 | drew@dccommercial.com.au